China's Photovoltaic Power Exports: Is the Wind Right for Setting Sail?

Release time:

2017-03-01

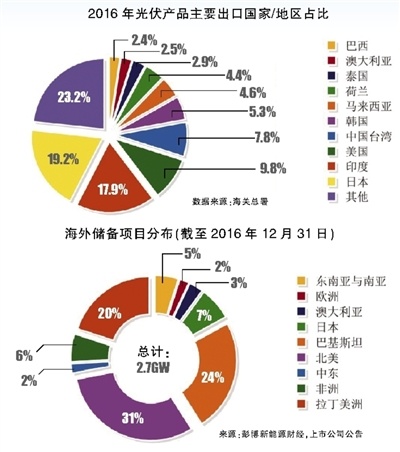

The outlook for China's photovoltaic foreign trade in 2016 was not optimistic. Data from the China Photovoltaic Industry Association shows that in 2016, China's photovoltaic product exports totaled US\$14 billion, a year-on-year decrease of 10.3%. Despite the contraction in total export value, China's photovoltaic products still account for a large share of the world's major photovoltaic markets, with an average monthly export value of US\$1.17 billion, representing a significant and competitive sector within China's foreign trade.

In 2016, the outlook for China's photovoltaic (PV) foreign trade was not optimistic. Data from the China Photovoltaic Industry Association shows that in 2016, China's PV product exports totaled US\$14 billion, a year-on-year decrease of 10.3%. Despite the contraction in total export value, China's PV products still account for a large share of the world's major PV markets, with an average monthly export value of US\$1.17 billion, representing a significant and competitive sector in China's foreign trade. Enter 2017, with the downward adjustment of PV subsidy mechanisms, intensified domestic market competition, the advancement of the "Belt and Road" initiative, and the development of international emerging markets, more and more PV companies have set their sights on overseas markets.

Capacity Expansion Concentrated Overseas

Despite the year-on-year decline in China's PV foreign trade exports, China's strong momentum in the international PV development landscape is undeniable.

As the world's largest PV manufacturer and PV power generation application country, while the export scale of China's PV products has expanded rapidly, its structure has also been continuously optimized and upgraded. Exports of silicon wafers and cells increased year-on-year. In 2016, nearly 3.5 billion silicon wafers were exported, a year-on-year increase of nearly 30%, and the export volume of cells approached 3GW, a year-on-year increase of over 11%. Modules, which account for the largest share of exported PV products (nearly 75%), decreased by 18% year-on-year. Polysilicon imports were nearly 14%, a year-on-year increase of over 20%.

In the view of Zhang Sen, secretary-general of the Photovoltaic Products Branch of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, the establishment of overseas factories by Chinese companies is one of the reasons for the changes in export structure. "Benefiting from the guidance of the 'Belt and Road' strategy, Chinese PV companies are investing and setting up factories overseas. On the one hand, this can expand production capacity to meet the growing global demand, and on the other hand, it can break through the barriers set by European and American markets for Chinese products and get closer to the end market." Zhang Sen further stated.

At the same time, China's PV industry technology level has continued to improve, repeatedly breaking world records, and the industrialization process of advanced scientific research results has significantly accelerated, with significant breakthroughs in polysilicon, silicon wafers, crystalline silicon cells, modules, and inverters.

Globally, PV capacity expansion continues. Wang Bohua, secretary-general of the China Photovoltaic Industry Association, said, "On the one hand, it is driven by the continued growth of the global market, and on the other hand, it is driven by technological advances. China's PV capacity has also expanded to varying degrees, with industry chain expansion concentrated in the modules and monocrystalline silicon wafer segments. Cell capacity expansion is mainly driven by the industrialization of PERC, black silicon, and N-type cell technologies, and is regionally concentrated overseas."

"Going Out" Becomes More Diversified

"Demand is dispersed, requiring meticulous development." Liu Yujing, an analyst at Bloomberg New Energy Finance, described the global PV market situation in 2017 in this way. Data from Bloomberg New Energy Finance shows that global PV demand in 2017 is showing a decentralized trend, and emerging markets will experience large-scale development.

Compared with 2014-2016, Bloomberg New Energy Finance predicts that from 2017 to 2018, whether in traditional markets such as India, the United States, Japan, and Europe, or in rapidly growing emerging markets such as Southeast Asia, South America, and the Middle East, the speed of new PV installations may slow down, but they will all maintain a certain amount of growth.

Bloomberg New Energy Finance predicts that emerging PV markets will continue to receive attention in 2017, and this attention may reach a new high. This is partly due to the global environment; the approval of the Paris Agreement has led various governments to set renewable energy development targets, calling for renewable energy to replace fossil fuels. On the other hand, some emerging markets have imperfect power infrastructure and large power deficits, while PV development has broad product markets and development space, making it favored by local governments, and various policy benefits have followed.

During the "13th Five-Year Plan" period, China's PV development has stabilized, and many PV companies, based on their own production capacity, technology, and market development considerations, have been making efforts in emerging markets.

According to the reporter's understanding, currently, half of China's PV product capacity is still used for export, with about 60% of the export volume concentrated in developing countries in Asia. In interviews, several PV companies revealed that Chinese PV companies have formed a certain scale of production capacity overseas, and their overseas shipments have continued to grow, with products such as modules being in short supply, "and in some emerging markets, a PV manufacturing industry dominated by Chinese PV companies has been formed."

"The manufacturing industry in emerging economies such as Southeast Asia is developing rapidly, and there is also a trend for China's manufacturing industry to move to Southeast Asia," Yang Xiaozhong, vice president of Trina Solar, told the reporter. "From our factories invested in Southeast Asian countries such as Thailand and Vietnam, we have brought new technologies and production lines, created jobs, and provided skills training, promoting the social and economic development of the local area."

The reporter learned that compared to the initial "going out" of China's PV industry, which involved the "going out" of equipment and sales, the "going out" is now more diversified and has a more stable foundation.

Chinese PV companies are developing overseas projects using BT, BOT, and other business models, jointly building demonstration parks, factories, and power stations, not only bringing advanced technologies and clean energy to the host countries but also creating jobs and benefiting people's livelihoods, promoting social and economic development. For example, Trina Solar has established four battery and module production bases in Malaysia, Thailand, Vietnam, and the Netherlands through mergers and acquisitions and investment. Recently, Trina Solar, on behalf of Chinese companies, officially released the first international standard, opening a precedent for Chinese PV companies to participate in the formulation of international standards and promoting the "Chinese standard" of PV to go global.

Many PV companies interviewed by the reporter said that the past model, which was mainly based on pure trade, is quietly changing. An overseas market manager of one company frankly stated, "The pure trade model is becoming unsustainable. Now, we are placing more emphasis on transforming into an integrated model of 'trade, production, and service'. We are continuously improving after-sales service to win more development space."

Latest developments